金融风险管理(上海杉达学院) 知到智慧树答案2024 z40436

第一章 单元测试

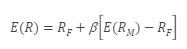

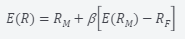

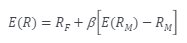

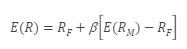

1、 Which formula describe the Capital Asset Pricing Model?( )

A:

B:

C:

答案:

2、 Which of the following descriptions are the assumption for Capital Asset Pricing Model?( )

A:Investors care only about expected return and standard deviation of return.

B:The  ‘s of different investments are independent.

‘s of different investments are independent.

C:Investors focus on returns over one period.

D:All investors can borrow or lend at the same risk-free rate.

E:Tax does not influence investment decisions.

F:All investors make the same estimates of  .

.

答案: Investors care only about expected return and standard deviation of return.

The  ‘s of different investments are independent.

‘s of different investments are independent.

Investors focus on returns over one period.

All investors can borrow or lend at the same risk-free rate.

Tax does not influence investment decisions.

All investors make the same estimates of  .

.

3、 The return from the market last year was 10% and the risk-free rate was 5%. A hedge fund manager with a beta of 0.6 has an alpha of 4%. What return did the hedge fund manager earn?( )

A:0.15

B:0.12

C:0.10

答案: 0.12

4、 Suppose the S&P 500 Index has an expected annual return of 7.2% and volatility of 8.2%. Suppose Andromeda Fund has an expected annual return of 6.8% and volatility of 7.0% and is benchmarked against the S&P 500 Index. According to the CAPM, if the risk-free rate is 2.2% per year, what is the beta of the Andromeda Fund?( )

A:0.20

B:0.90

C:0.92

D:1.23

答案: 0.92

5、 If a bond issued by a company have a rating of AAA, the company generally can not be referred to as having a rating of AA.( )

A:对

B:错

答案: 对

第二章 单元测试

1、 Which of the following table reflects the change of structure of banking in the United States between 1984 and 2017?( )

A:

B:

C:

答案:

2、 __ measures the return to stockholders on their investment in the bank. It is the product of net profit margin, asset utilization and the equity multiplier.( )

A:ROA

B:ROE

C:Net profit margin

答案: ROE

3、 Loan losses on the income statement of DLC Bank is associated with operational risk.( )

A:对

B:错

答案: 错

4、 Net interest income on the income statement of DLC Bank is associated with market risk.( )

A:对

B:错

答案: 对

5、 Non-interest expense on the income statement of DLC Bank is associated with credit risk.( )

A:对

B:错

答案: 错

第三章 单元测试

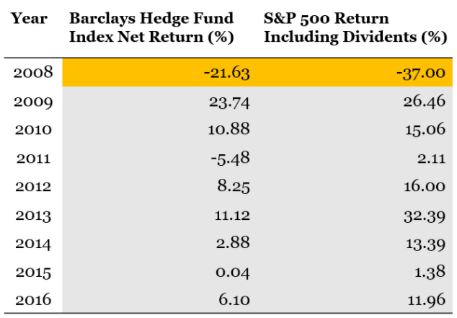

1、 Select one or more correct statements about the performance of hedge fund:

( )

A:The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but not between 2009 and 2016

B:Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing well

C:The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well

答案: The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but not between 2009 and 2016

Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing well

The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well

2、 A fund of funds divides its money between five hedge funds that earn –5%, 1%, 10%, 15%, and 20% before fees in a particular year. The fund of funds charges 1 plus 10% and the hedge funds charge 2 plus 20%. The hedge funds’ incentive fees are calculated on the return after management fees. The fund of funds incentive fee is calculated on the net (after management fees and incentive fees) average return of the hedge funds in which it invests and after its own management fee has been subtracted. What is the overall return on the investments?( )

A:8.2%

B:10.2%

C:5.4%

答案: 8.2%

3、 Long/short funds tend to invest primarily in publicly traded equity and their derivatives, and tend to be short biased.( )

A:对

B:错

答案: 错

4、 Global macro strategy involves both directional analysis, which seeks to predict the rise or decline of a country’s economy, as well as relative analysis, evaluating economic trends relative to each other.( )

A:对

B:错

答案: 对

5、 Global macro funds are not confined to any specific investment vehicle or asset class, and can include investment in equity, debt, commodities, futures, currencies, real estate and other assets in various countries.( )

A:对

B:错

答案: 对

第四章 单元测试

1、 When a trader enters into a short forward contract when the forward price is $50, the trader is obligated to buy the asset for $50. (The trader does not have a choice).( )

A:对

B:错

答案: 错

2、 An investor enters into a short forward contract to sell 100,000 British pounds for U.S. dollars at an exchange rate of 1.3000 U.S. dollars per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is 1.3900?( )

A:-$1,000

B:-$9,000

C:$9,000

答案: -$9,000

3、 A French bank enters into a 6-month forward contract with an importer to sell GBP 60 million in 6 months at a rate of EUR 1.15 per GBP 1. If in 6 months the exchange rate is EUR 1.13 per GBP 1, what is the payoff for the bank from the forward contract?( )

A:EUR -2,000,000

B:EUR -1,200,000

C:EUR 1,200,000

答案: EUR 1,200,000

4、 When a trader intends to short selling, his broker would borrow the securities from another client and sell them in the market in the usual way.( )

A:对

B:错

答案: 对

5、 When a trader shorts selling a stock, he must pay dividend and other benefits the owner of the securities receives.( )

A:对

B:错

答案: 对

下方是付费阅读内容:本平台商品均为虚拟商品,无法用作二次销售,不支持退换货,请在购买前确认您需要购买的资料准确无误后再购买,望知悉!

完整答案需点击上方按钮支付5元购买,所有答案均为章节测试答案,无期末答案。购买后上方矩形框将出现已付费的隐藏内容。

点关注,不迷路,微信扫一扫下方二维码

关注我们的公众号:阿布查查 随时查看答案,网课轻松过

为了方便下次阅读,建议在浏览器添加书签收藏本网页

电脑浏览器添加/查看书签方法

1.按键盘的ctrl键+D键,收藏本页面

2.下次如何查看收藏的网页?

点击浏览器右上角-【工具】或者【收藏夹】查看收藏的网页

手机浏览器添加/查看书签方法

一、百度APP添加/查看书签方法

1.点击底部五角星收藏本网页

2.下次如何查看收藏的网页?

点击右上角【┇】-再点击【收藏中心】查看

二、其他手机浏览器添加/查看书签方法

1.点击【设置】-【添加书签】收藏本网页

2.下次如何查看收藏的网页?

点击【设置】-【书签/历史】查看收藏的网页